Recently, senior citizens in Pierce County have been receiving misleading postcards regarding Property Tax Exemptions.

The postcard identifies that seniors earning less than $34,000 (after deductions) may be eligible for a reduction and gives the impression that senior citizens should act fast or they could lose out on property tax exemptions or refunds.

Ken Madsen, Pierce County Assessor-Treasurer, wants seniors in Pierce County to know that this is not a Pierce County Assessor-Treasurer mailing.

If seniors are receiving calls for appointments, these calls are not calls from Pierce County Assessor-Treasurer employees.

Pierce County has no connection with the persons mailing the postcards.

The Attorney Generals office has been contacted regarding the legality of the mailing and the Assessor-Treasurers office is currently awaiting a reply.

In the meantime, Madsen warns senior citizens who receive such a postcard to be cautious about signing documentation, or putting your property up as collateral without first obtaining a second opinion and/or researching claims or benefits promised.

Madsen warns that this may be an opportunity for unwanted solicitors to gain access and potentially take advantage of seniors in Pierce County.

We are actively educating the citizens of Pierce County regarding exemptions available, especially our senior and disabled citizens. We want to partner with them to maximize the legal benefits available. Our Senior Department is happy to review documentation and provide the exemption to qualifying seniors and disabled persons, Madsen stated.

State law clearly identifies the qualifications required for the Senior Citizen and Disabled Persons Exemption. Seniors must be at least 61 years old on December 31 of the year of application. Applicants must have a total annual household income, including that of a spouse and any co-tenants of less than $30,000.

Seniors are encouraged to contact the Assessor-Treasurers office or visit the Web site at www.piercecountywa.org/atr for additional information.

More Stories From This Author

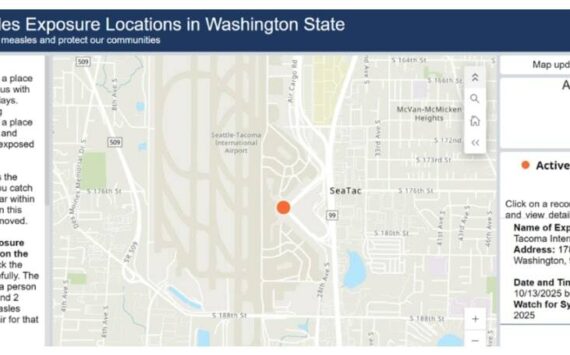

New map tracks measles exposures...

By Jake Goldstein-Street, Washington State Standard

Bills Towing-Auction Notice

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

NO. 25-4-02069-2- Notice to Creditors

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

CITY OF FIRCREST -NOTICE OF...

By Amanda Kahlke amanda.kahlke@tacomadailyindex.com

New map tracks measles exposures across WA

Afraid you may have been exposed to measles? Washington’s Department of Health is launching an online tracker showing locations where…

By Jake Goldstein-Street, Washington State Standard • October 24, 2025 5:12 am

WA health insurance buyers confront steep price hikes

The roughly 300,000 Washingtonians who buy health insurance through the state’s online marketplace are set for a rude awakening as…

By Jake Goldstein-Street, Washington State Standard • October 23, 2025 5:12 am

WA State Patrol to step up protection efforts for lawmakers

Washington State Patrol Chief John Batiste says that in response to increased political threats against public officials nationwide, the agency…

By Paul W. Taylor, TVW • October 22, 2025 5:12 am