Wage increases – not much and not for very many of us

By Morf Morford

Tacoma Daily Index

Politicians are notorious for claiming credit for work they didn’t do or that was done before they came along. Exaggeration and hyperbole is part of the landscape. If you or I spoke like that, or represented ourselves on our resumes as having made those accomplishments, we’d be fired or worse.

When it comes to pay, for example, annual cost of living increases used to be standard. These pay increases would be tied to the cost of living and would match the rate of inflation. The assumption was not that this would be a raise – at least in the usual sense – but an increase in pay that would maintain pay in balance with the increase of the cost of basic goods.

The cost of living, never equal in different parts of the country, changes at different rates – even within different neighborhoods – and is rarely, if ever static.

As much as most of us would like a pay raise, any large scale increase brings chaos.

We are safe from that particular hazard.

But we are not safe from stagnating pay scales.

About 20 states raised their minimum wages at the outset of 2020. Most had not changed their minimum wage for years – if not decades.

The federal minimum wage remains unchanged at $7.25 per hour.

The minimum wage, we tend to forget, is the minimum living wage. It is NOT a training wage or a beginner’s pay (for part-time teenagers for example).

The average age for someone who makes minimum wage is 35 – and a third of them are at least 40. (1*)

And the number of people working at (or near) minimum wage is increasing – as is the number of those with more than one minimum wage job.

About 5 percent of part-time workers (people who usually work fewer than 35 hours per week) were paid the federal minimum wage or less, compared with about 1 percent of full-time workers.

The states with the highest percentages of hourly paid workers earning at or below the minimum wage were in the South: Louisiana (about 5 percent) and South Carolina (about 4 percent). In the District of Columbia, about 4 percent of workers were paid at or below the federal minimum. The states with the lowest percentages of hourly paid workers earning at or below the federal minimum wage were in the West or Midwest: Alaska, Minnesota, Oregon, and Washington (all were less than 1 percent).

If the minimum wage pay had tracked with the pace of inflation and productivity, it would be close to $25 per hour.

The reality is that any increase has not been much, and it has not reached many of us.

Our president, at his recent State of the Union Address emphasized that the lowest income workers “have seen a 16 percent pay increase since my election.”

According to the Bureau of Labor Statistics, in the fourth quarter of 2019, median weekly earnings for full-time wage and salary workers rose by 4 percent to $936. For the full year, median weekly earnings for men rose by 2.9 percent and by 6.2 percent for women.

So over the year, average pay went up, for men, just under 3% and for women a bit over 6%.

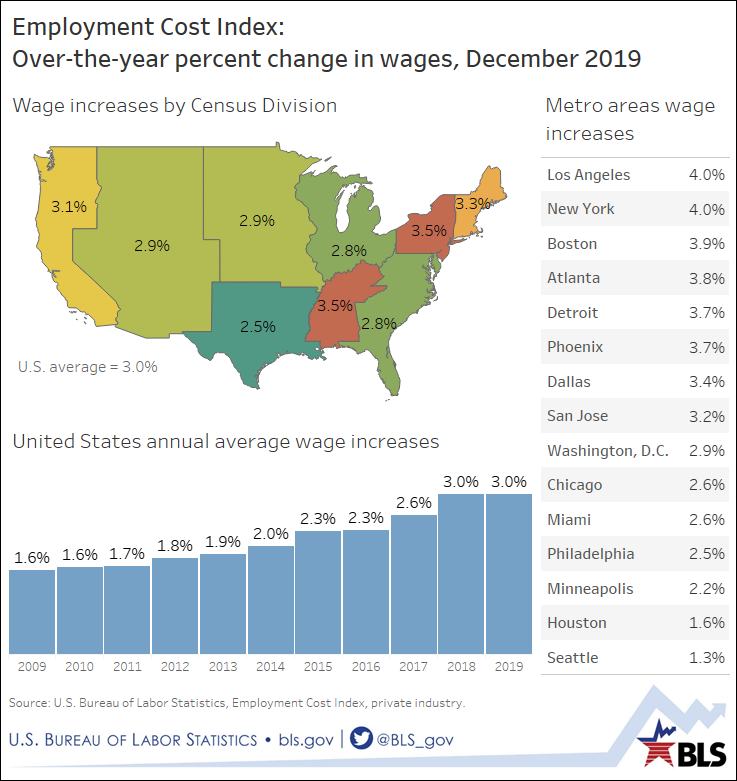

As you can see from the chart, that pay increase was not equally distributed across the country – and approached 16% nowhere visible on the map.

The greater Seattle area had an increase of barely over 1%.

Just a reminder, 1% means an additional dollar for every hundred.

A one percent increase – or even a 3% increase – will be barely noticeable for your monthly budget.

And a 4% increase in Los Angeles (or San Francisco or New York) is laughable.

President Trump endorsed a 2.6 percent pay raise for federal employees which began in January 2020.

For a comparison, average rent increases in New York City are reliably about 3% per year.

Meanwhile, closer to home, between 2010 and 2018 average rent in the Seattle area rose 69% while inflation in the same region rose just over 20%.

Tacoma rents went up about 5% in 2019 (meanwhile, in Spanaway, rents went down by 5%).

Who had a 5% pay increase?

No one I know.

Those with savings accounts can expect about a 1% return.

I just heard an interview with former Federal Reserve Chair Janet Yellen who projected growth for 2020 to be in the 1.8% range, with 2% being optimistic.

She also sees variables which will impact our economy directly, like our national debt, soon – and not in a positive direction. (2*)

We are not alone in this; Europe has about a 1% growth rate and Japan holds at about .7% – a bit less than half the US growth rate.

Add in variables like the coronavirus, trade tariffs and Brexit, and you have a recipe for continued slow growth.

No matter what happens, it looks like an interesting year.

(1*) https://www.nytimes.com/2014/06/10/upshot/minimum-wage.html. You can see extensive details on the minimum wage here https://www.bls.gov/opub/reports/minimum-wage/2018/pdf/home.pdf