Having a credit score that is not up to the mark is not as big a deal as it used to be. People looking for safe ways to get online personal loans despite having a poor credit score may feel like they have run out of possibilities. Consider that several loan providers out there want your business.

If you’re wondering what they get out of it, the answer is straightforward. Instead of paying excessive interest rates to financial institutions like banks, you simply hand the money to these lenders. These lenders do not care about your credit report or your fico score.

Hundreds of lenders are eager to secure your business and provide you with the loans you require at an interest rate that is flexible and pre-determined between the lender and you.

Even if credit unions are not in your favor and you cannot secure a reasonable loan amount from banks, loans for bad credit are still a great option. We have put together a list of great options for bad credit loans.

The Best Bad Credit Lenders in 2022

Below is a list of the best bad credit lenders available:

| MoneyMutual | Personal loans are quickly credited to your account with no worry of credit score. |

|---|---|

| BadCreditLoans | Loans for bad credit up to $10,000 at no origination fee |

| PickALender | Low origination fees, personal loans of high amounts, and a wide selection of lenders |

| CashUSA | Secure platform with low origination fee and instantly credited amounts of personal loans |

| PersonalLoans | Personal loans for debt consolidation at a low origination fee |

| Lend You | Get $2500 in no time from trusted lenders using this platform to take care of your debt consolidation needs and more. |

| Next Day Personal Loan | Highly secure platform and can connect with lenders immediately. |

| Upgrade Personal Loans | Get unsecured personal loans and more high amounts, with a rate of 2.9% to 8% origination fee, which is deducted from the loan proceeds |

| Payzonno | A simple and easy-to-use platform for debt consolidation needs |

MoneyMutual

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $200 to $5000 |

| APR | Varies |

| Term Length | Varies |

MoneyMutual does not charge any origination fee from poor credit borrowers, thus making this one of the best platforms we have listed. The interest rates and other details of the repayment terms can be discussed directly with the lender. You can avoid the prepayment penalty by speaking with the lender and agreeing with them.

You do not have to worry about undergoing many procedures for loan approval. The online lenders on this platform are ready to give you loan funds up to $5000 even if you have bad credit.

With over 120 vetted lenders across the country, MoneyMutual offers a safe and secure lending platform. These lenders don’t care about your FICO score. The platform is fast, trustworthy, and easy to use. MoneyMutual has helped over 2,000,000 consumers get personal loans for bad credit and continues to help individuals in many ways.

You can connect with lenders who are ready to give you loans for bad credit without putting you through many procedures of credit checks or having you meet a minimum credit score requirement to get hold of their money. You can get various unsecured and secured loans based on your agreement with the lender.

There is no hassle of borrowing minimum loan amounts; you can borrow as much or as little. You can settle your debt through secure monthly payments without worrying about anything else. This platform is easy to use. When you log into the website, a brief questionnaire asks you for basic information. Your account is credited with the loan proceeds within 24 hours.

BadCreditLoans

| Company Overview | |

|---|---|

| Type of Loan | Multiple |

| Loan Amount Range | $500 to $10,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 60 Months |

BadCreditLoans is an excellent source for fast personal loans for bad credit. Without undergoing strict credit check procedures, you can get loans between $500 to $10,000 in no time at all. You have to meet no minimum credit score requirement to qualify for the payday loans you can obtain from the lenders on the platform.

Borrowing money from the lenders using this platform is easy, and you can get hold of secured and unsecured loans and pay them back in flexible monthly payments as arranged with the lender. The services on the platform are entirely free, and you do not have to pay an origination fee to get loans for bad credit.

In exchange for connecting you with lenders, BadCreditLoans charges them a fee. The borrower will not lose money. The interest rates and other repayment terms can be discussed directly with the lenders. Depending on your agreement, and the flexibility, you will not be charged a prepayment penalty. If you have any questions, you can contact the lender directly through the site.

Generally, loan approval procedures are pretty hectic, and getting hold of bad credit personal loans can be cumbersome. But with this platform, the loan proceeds from the online lenders will be credited into your account, and the loan funds for bad credit are pretty flexible.

PickALender

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $100 to $40,000 |

| APR | Varies |

| Term Length | Varies |

Getting a bad credit loan on PickALender is easy. All you have to do is fill out a short application form. You can choose to pay the loan back through monthly payments.

There is no requirement of a minimum credit score or a strict credit check to obtain personal loans for bad credit using this platform. This platform brings you some of the best personal loans, even if your fico score is not so great. This is one of the most transparent platforms on our list, offering loans for people with poor credit scores.

Can you imagine getting payday loans up to $40,000 within just a day without going through the numerous procedures that you generally would for loan approval?

PickALender brings you an excellent platform connecting you with top online lenders for bad credit personal loans. This is one of the platforms offering among the highest loan funds for bad credit.

According to different credit unions, a network of lenders and a very secure platform is one of the best options for those whose credit score is not up to the mark. You can discuss the repayment terms and the interest rate that you are comfortable with directly with the lenders.

Your bad credit will not stop you from getting an excellent personal loan from a reliable bad credit lender should you choose to use this platform.

CashUSA

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $500 to $10,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 72 months |

CashUSA prides itself on bringing you payday loans within just 24 hours for all your emergency needs without having you go through different obstacles for loan approval. No matter what you need the money for, you can get the best personal loans on this platform from online lenders who do not care about your poor credit background.

You can get loan funds up to $10,000 through this platform within just a day. The repayment terms are flexible and transparent, and you can discuss the interest rate directly with the lender. Compared to institutions like banks, the interest rates are pretty low for personal loans for bad credit.

If you are looking for a bad credit personal loan, security is something that you must consider. If you are looking for a secure platform that can connect you with a reliable bad credit lender, you cannot go wrong with this platform. CashUSA has a network of lenders who couldn’t care less about your bad credit score. You don’t have to worry about paying a hefty origination fee when you use this platform.

The minimum loan amounts that you can borrow are hundred dollars, so if that’s all you need- just fill that out in the form! You can discuss monthly payment options directly with the lender and agree with them. Usually, credit check procedures are pretty time-consuming depending on the score you have as per credit unions.

However, you can easily get loans for bad credit within one business day through this platform.

PersonalLoans

| Company Overview | |

|---|---|

| Type of Loan | All-purpose loans |

| Loan Amount Range | $500 to $35,000 |

| APR | 5.99% – 35.99% |

| Term Length | 3 to 72 Months |

PersonalLoans brings you loans for bad credit without any minimum credit score requirement. You can get flexible loan amounts up to $35,000 and pay them back in monthly payments as agreed between you and the lender that you choose. You do not have to worry about spending too much money in the form of an origination fee to use the platform.

Compared to other bad credit loan companies, the company brought you a very secure and easy-to-use platform. They have a broader range of lenders that you can choose from. After completing a short application form, you will have the option to choose the bad credit lender that you want from a list of many choices of lenders who do not care about bad credit scores.

Getting hold of a bad credit personal loan is accessible through this platform. Bad credit borrowers can directly communicate with the lenders regarding the personal loans for bad credit scores and discuss everything upfront. There are no hidden charges or heavy interest rates. The interest rate and other details of the repayment terms are entirely transparent and at the complete discretion of you and the lender.

All the information you give to this loan company is secure, and the online lenders are entirely trustworthy because the platform has verified them. The loan proceeds are pretty quick, and even with your bad credit, you do not have to wait for too long to take care of your personal needs that require immediate funds.

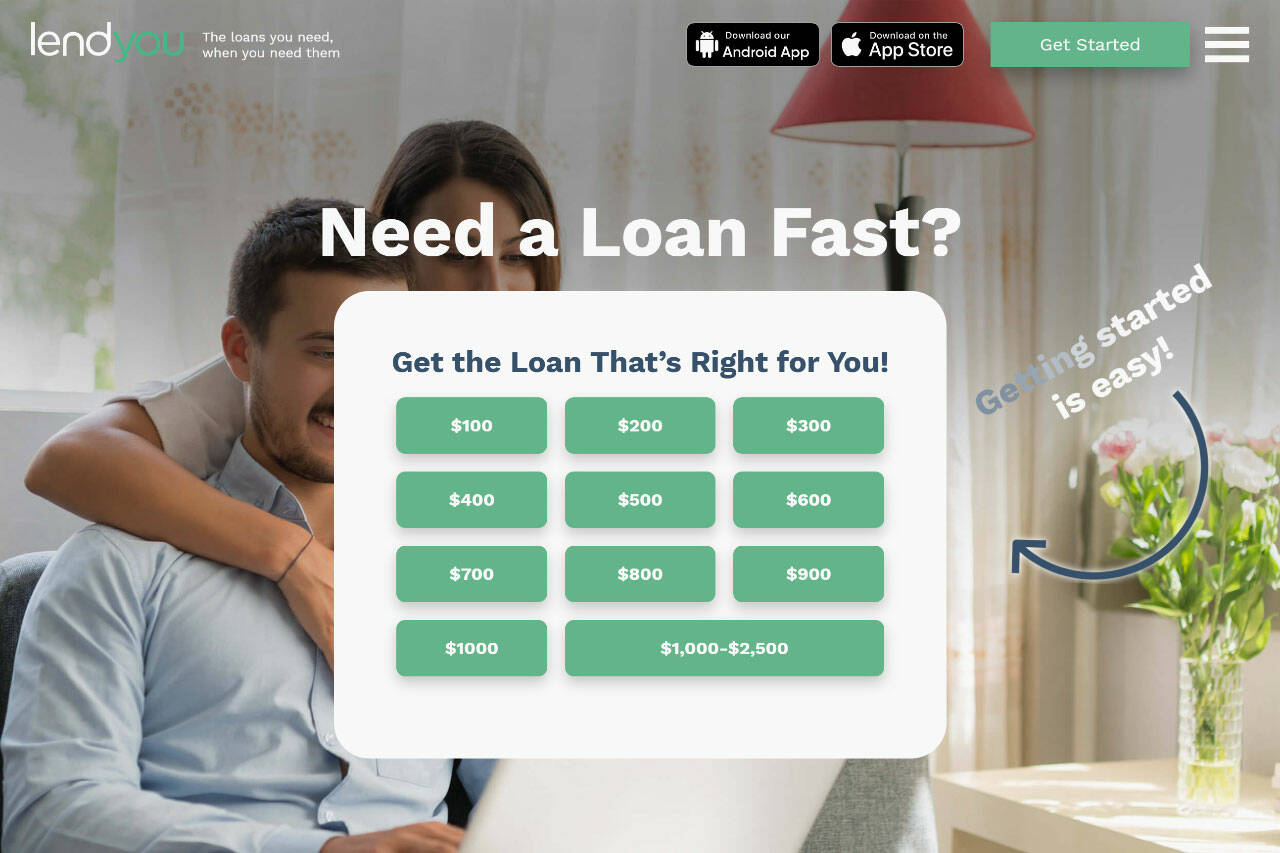

LendYou

| Company Overview | |

|---|---|

| Type of Loan | Short-Term, Installment, and Personal Loans |

| Loan Amount Range | $100 to $15,000 |

| APR | 6.63% – 225% |

| Term Length | 30 days to 60 months |

LendYou does not care about what the credit unions have to say about your low credit scores. You can borrow secured and unsecured loans directly from the lenders without any minimum credit score requirement. You can get loan amounts up to $2500 in a single day. There is no hefty origination fee even if you have bad credit scores. If you are looking for a bad credit personal loan without much hassle, this is a great platform that you can trust.

If you are looking for a secure platform to obtain loan amounts up to $2500 in no time from trustworthy online lenders, you cannot go wrong with LendYou. This loan company is one of the most reliable platforms on our list. You can connect directly with top lenders in your area who offer bad credit score holders loans without much thought into credit check procedures.

You can discuss the repayment terms and interest rates directly with the lenders and ensure there is no prepayment penalty. You need to satisfy very few conditions to obtain personal loans for a bad credit score through this website. The bad credit borrowers should not be associated with the US military, and they must have a minimum monthly income of thousand dollars.

Next Day Personal Loan

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $1,500 to $40,000 |

| APR | 6% – 35.99% |

| Term Length | 2 to 180 months |

Next Day Personal Loan has one of the highest offerings of loan amounts on our list. The platform does not charge you a hefty origination fee to get you started. Bad credit borrowers do not have to worry about getting scammed when looking for loans for bad credit scores on this platform. Everything on this platform is simple and transparent.

Discuss the repayment terms and other details like the interest rates directly with the lenders, and only choose them if you are comfortable with the agreement.

You can directly speak to them about the prepayment penalties and other conditions. This loan company is known for its high loan funds and a large selection of online lenders. The loan proceeds are transferred quickly into your account once you have signed all the required documentation.

Next Day Personal Loan is a trustworthy platform bringing you some of the best bad credit loans out there, and there is no restriction on the amount you can borrow, irrespective of what credit unions have to say about your score.

It does not matter if your credit scores are low according to one credit union or many credit unions; you can borrow up to $40,000 in just a day through this platform.

One of the most significant components of this platform is security, which sets it different from the other organizations we’ve discussed. 256-bit encryption provides excellent data security. You do not have to worry about any minimum credit score to maintain to secure payday loans through this platform. You can repay the unsecured loans you obtain through monthly payments at the interest rate discussed with the lender.

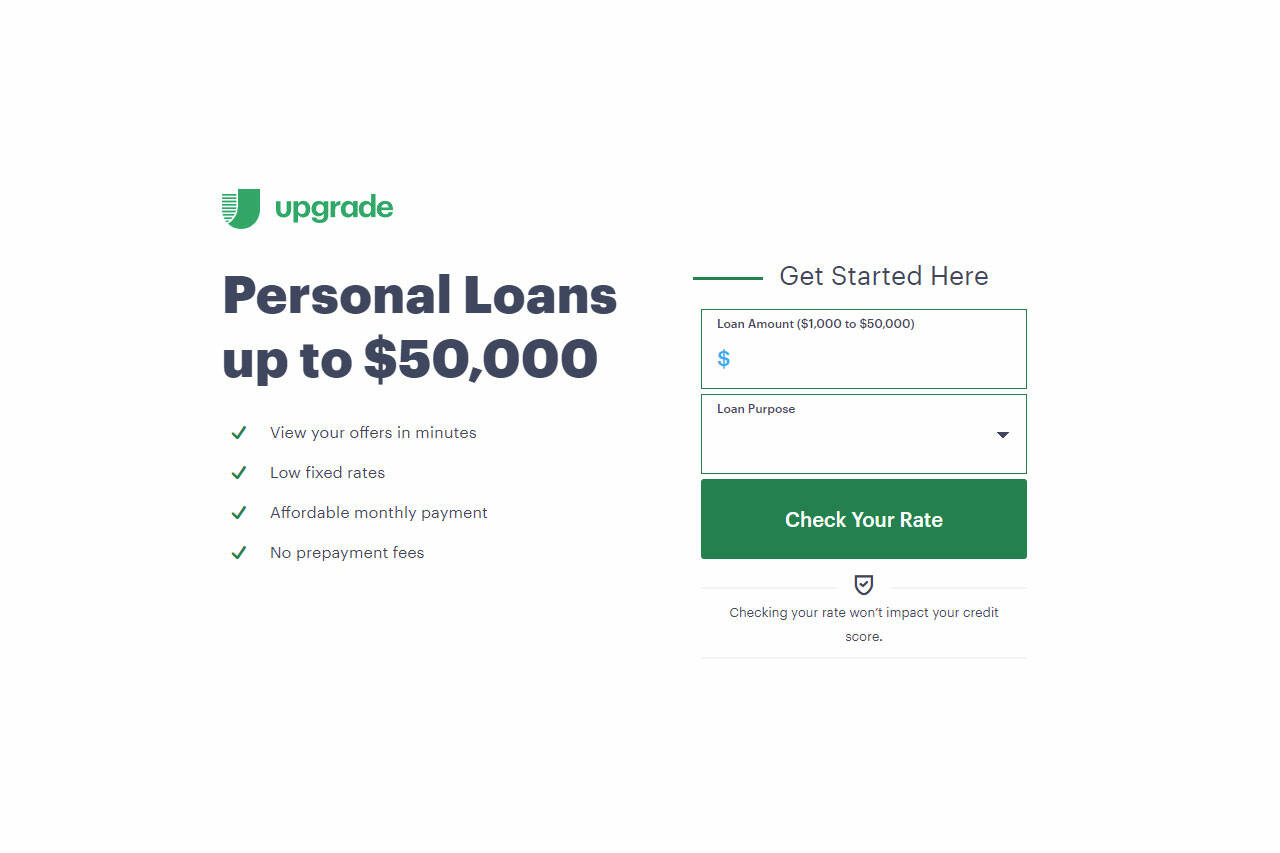

Upgrade Personal Loans

| Company Overview | |

|---|---|

| Type of Loan | Personal Loans |

| Loan Amount Range | $1,000 to $50,000 |

| APR | 5.94% – 35.97% |

| Term Length | 2 to 7 years |

Even if multiple credit unions have deemed that you do not meet the minimum credit score required to get money from banks, you can get secured and unsecured loans through Upgrade Personal Loans so long as you have a 560 minimum credit score. You can repay the loans through fixed monthly payments, and you do not have to worry about paying a hefty origination fee to get you started as it will only be 2.9% to 8%, which is deducted from the loan proceeds.

With 5.94% to 35.97% APRs, Upgrade is one of the most attractive options on our list of the best bad credit loans. This is one of the most secure platforms, and everything, including the loan proceeds, happens instantly.

You can directly discuss monthly payment agreements, repayment terms, and interest rates with the lenders. This company is one of your best options to get loans for bad credit without worrying about satisfying any minimum credit history or being scrutinized for your credit report.

The online personal loan providers on this platform bring you loan amounts up to $50,000, which is higher than all the other platforms that we have listed. You can get some of the best personal loans through this platform. You must note that if your credit score is higher, you will be able to negotiate a better interest rate for yourself. There are many loan options available, and your score by the credit union doesn’t change this.

Payzonno

| Company Overview | |

|---|---|

| Type of Loan | Personal Loan |

| Loan Amount Range | $100 to $5,000 |

| APR | Varies |

| Term Length | 1 to 60 Months |

Payzonno is one of the best options if you look for loans with bad credit scores and do not have the required credit report or minimum credit history to make you eligible to borrow money from banks and other similar institutions. The payday lenders on this platform do not care much about putting you through a strict credit check. Whether one credit union or several credit unions have declared that you do not have the minimum credit score to get loans from the bank, you can rely on this platform instead.

After assessing your current financial situation, you are provided with options from many lenders ready to give you secured and unsecured loans. You can repay the loan through fixed monthly payments as agreed between you and the lender that you have selected. You can get loan amounts up to $5000 through this platform within just one business day.

Payzonno does not charge you an origination fee. Your bad credit scores do not matter as you have many options of loans for a bad credit score. This is one of the more straightforward platforms for poor credit borrowers. Everything on this platform is transparent, and you can discuss repayment terms and interest rates directly with the lender. This is indeed one of the best bad credit loan platforms we have listed.

How We Ranked The Best Bad Credit Lenders

Ranking the companies that provide personal loans for bad credit was not an easy task for our team. We had to consider so many things, including your chances of finding a reliable online lender and the speed of the money getting credited into your checking account.

If you are looking to obtain a payday loan from an online lender, security is one of the most important things you must consider. This is what we did as well when comparing personal loan lenders on different platforms who didn’t pay much attention to the reports by credit unions.

Credit Score Requirement

The idea is to get the amount credited into your bank account without the hassle of meeting a minimum credit score. We prefer lenders who do not care about your current credit scores and do not have any expectation of a minimum credit score from you.

You can get a loan with poor credit through our listed platforms, irrespective of your credit scores. We made sure that there is no requirement of a minimum credit score, and we also made sure that the money gets credited into your checking account pretty fast. Unlike banks, the lenders on our list of platforms do not care whether you meet the minimum credit score expectations.

Loan Amount Offered

Getting loan amounts that you need can be quite the hassle when you go through unconventional sources. The loan amount you wish to borrow might be to clear your credit card debt. Without a fair credit score, it can be tough to get hold of a high loan amount to take care of your emergency expenses.

We ensured they offered high and flexible loan amounts when we ranked these platforms. We made sure that the loan amount was adjustable because that should be no compulsion to borrow a minimum quantity. The loan amount that you get from the direct lenders on the platforms that we have listed is up to you entirely. You can borrow a loan amount of as little as a hundred dollars.

The loan amount that you borrow is entirely up to you. You can get a loan with a poor credit score from trustworthy lenders into your account in the loan amount that you choose from these lenders.

Interest Rates

We have put together a list of those platforms that offer you the lowest interest for debt consolidation loans and other options for a loan with bad credit. The amount will be credited into your checking account, and the interest rate can be negotiated directly with the lenders on the platform.

The interest rates have to be reasonable and within your budget. To be fair, the credit score does have a say in the interest rates that you have to pay, even on the platforms that we have listed. The general trend is that the interest rates go higher if your score is not that great. When borrowing a high loan amount from personal loan lenders, make sure that you discuss the interest rate upfront.

Loan Types Offered – Secured vs. Unsecured

Irrespective of your credit score, we made sure that there are multiple options of loans available for you. Just as crucial as the interest rate and origination fee are choices of loan types. Both possibilities of a secured loan and an unsecured type of loan are available on the platforms that we have listed.

You can get a high loan amount and maximum unsecured loan services from direct lenders into your checking account to take care of your credit card debt.

Loan Options Available

The different loan options available are just as important as the type of loan you can get. Whether it is debt consolidation loans that you are after or credit card consolidation, you have many loan options on the listed platforms.

If you are looking for a debt consolidation loan from the lenders that we have listed, you can be sure that you will get a loan for bad credit that is trustworthy and secure.

Documentation Requirements

The credit score is not the only thing that is bothersome about securing a loan in a typical way. Just as cumbersome as maintaining a credit score, even if it is a fair credit score, is dealing with numerous reports and other documentation.

Not only are the documentation requirements minimal for the loan with bad credit options we have listed, but you will also be connected with direct lenders offering you online loans irrespective of your credit score.

You do not have to worry about whether the online lender is trustworthy or not either- all these platforms are known for their security. You can also get the best interest-rate options.

Origination Fees Required

The origination fees must be fair when considering using a platform to borrow money from direct lenders. Most of the platforms we have listed where you can get a loan with bad credit have either no origination fee or significantly fewer origination fees.

The origination fees are minimal, and this is important because you are looking for a loan with bad credit. With a low origination fee, you can just be bothered about the money credited into your checking account rather than debited from it.

Speed of Deposit

The deposit speed is critical because the money has to get credited into your account within the minimal time possible. Your checking account must have received the loan with bad credit from the lender within one business day.

After comparing lenders, we have listed the best personal loans from those platforms, considering the time it takes to get the amount credited into your checking account.

Ties With Credit Bureaus

We always look for platforms with ties with major credit bureaus to increase their trustworthiness. Major credit bureaus usually organize with those companies that offer loans for bad credit, which have earned a strong reputation.

Even if you have poor credit scores, you should be able to secure a loan with bad credit in your checking account. The platforms that we have listed are reliable and trustworthy. If your credit score is not really up to the mark, they are an excellent option.

Repayment Terms

Having a poor credit score can place a lot of hassle when looking for a loan with bad credit because sometimes you will have to agree to repayment terms that you are not comfortable with.

We looked for those options that bring you a loan with bad credit into your checking account and have multiple loan options with flexible repayment terms.

What Is A Bad Credit Loan?

A bad credit loan is a type of unsecured personal loan that can be used to consolidate debt, pay off high-interest credit cards or even buy a new car. The term “bad” in the name refers to your credit score. If you have a low score, you’ll need to find lenders willing to lend to people with poor credit ratings.

The good news is that lenders will still give you money based on your history and not necessarily how much money you make. Some companies may offer loans at lower interest rates than others. Before applying, you need to research and know what terms you’re looking for.

If other lenders have turned you down, don’t worry: There’s hope! Here are five places to get a bad credit loan: consolidate debts, pay off old bills, or finance a new purchase.

What’s the Difference Between a Good and Bad Credit Score?

Your credit score is one of three significant factors banks use when deciding whether to approve you for a loan. It ranges from 300 to 850 (with 700 being considered perfect). Your score is calculated based on how long it takes you to repay debts, how much you owe compared with what you can pay back each month, and other measures.

There are several different types of scores that lenders calculate. One of the most common is FICO or Fair Isaac Corporation. This scoring system was developed by Fair Isaac, a company that provides credit-scoring services to institutions (financial).

FICO scores range from 300 to 850, with a higher number indicating better creditworthiness. If your score falls below 620, you could pay more interest on your credit card balance than if you had a higher score.

To get an accurate picture of your overall credit health, you should check all three areas: your payment history, your total amount owed, and your available credit.

What Is A Credit Union?

Credit unions are organizations owned by their members, and they often provide financial products such as checking accounts, mortgages, and auto loans. They charge less in fees than traditional banks, but they also tend to have higher interest rates and stricter requirements for membership.

Some credit unions require proof of employment or income; others restrict eligibility to those who live within a certain distance of the organization’s location. Some credit unions also limit access to their services based on age or marital status.

You might think you’d only want to join a credit union if you’re already a member of another financial institution. However, many credit unions offer savings accounts, insurance policies, and investment opportunities that other financial institutions don’t provide.

Credit Unions Vs. Bad Credit Loan Lenders – Which Is Better?

Credit unions have lower overhead costs than large banks because they generally don’t maintain sprawling branches across the country. As a result, they tend to be cheaper to operate than big banks.

In addition, credit unions usually keep fewer records about their customers than larger banks. If you have good credit, your report won’t contain any negative information that could hurt your chances of getting approved for a loan.

However, if you have poor credit, you’ll likely face greater scrutiny from credit unions than traditional banks. Credit unions typically rely on credit reports to determine whether to extend you a loan. So, even though your credit isn’t great, you may still qualify for a loan if the lender believes that you’ll be able to make payments.

This doesn’t mean that you should give up hope of obtaining financing through a bank. Some low-interest personal loans can help improve your credit score. These short-term loans allow you to clear up any outstanding debt before applying for a longer-term loan.

How Much Can I Borrow From A Credit Union?

Most credit unions will not lend money at above 80% APR. The maximum APR allowed varies by state, but it’s unlikely that you’ll be able to receive a loan with an APR above 36%.

If you need to borrow more than $5,000, you’ll probably need to apply for a mortgage. You can still obtain a home equity line of credit from a credit union, but the loan size is limited to $100,000.

If you decide to seek out a personal loan from a credit union, pay attention to how much you can afford to repay each month. Most lenders will ask you to pledge collateral (such as your car title), so they can secure your loan. You’ll be responsible for repaying the entire loan even if you default on your monthly installments.

Credit Unions vs. Banks – What Are The Differences?

There are several differences between credit unions and banks. Here are some of the main ones:

- Fees – While there are no upfront fees associated with opening an account at a credit union, banks usually charge one or two months’ worth of interest when you first open your account.

- Deposits – Many credit unions let you deposit checks in person without incurring additional service charges. Banks often charge a fee for depositing checks.

- Rates – Credit unions frequently offer better rates than banks for auto loans, mortgages, student loans, and small business loans.

- Member Benefits – Credit unions often offer free checking accounts and online bill payment options. They also often provide members with discounts on health care products and services.

- Service – Credit unions are typically smaller organizations, making them easier to navigate. They also normally employ less staff than banks and credit card companies.

- Size – Credit unions tend to be smaller than banks. For example, most credit unions are chartered under the National Credit Union Administration (NCUA), while banks are chartered under the Office of the Comptroller of the Currency (OCC).

- Reputation – Credit unions generally enjoy a higher standing than banks. This is mainly because many people choose to join credit unions over banks. After all, they’re more familiar with the organization.

- Transparency – Some credit unions are more transparent than others. For example, some credit unions will post their financial statements online. Other credit unions don’t disclose their finances publicly.

- Memberships – Credit unions tend to attract a particular type of member. Typically, these individuals belong to a specific religion, profession, political party, or social group.

- Lending Limits – Some credit unions have lower lending limits than those found at banks. These institutions may also be more willing to make large loans to qualified applicants.

How To Get Out Of Debt Fast?

If you find yourself in a situation where you owe more than you earn, you may need to consider getting out of debt fast. There are several reasons why this may be necessary, including medical bills, unexpected expenses, and other unforeseen events.

To successfully get out of debt, specific steps must be taken. First, you’ll need to determine how much money you owe. Next, you’ll need to decide what type of loan you’re most comfortable with. Finally, you should work with a reputable debt consolidation company to set up a payment plan that works for you.

Before you take any action, you’ll need to evaluate your current situation carefully. You’ll want to make sure that you’re not overextending yourself financially. If you’ve been making regular payments on high-interest loans, you may want to consolidate them into one low monthly payment.

You also need to make sure that your creditors aren’t overcharging you. You might notice that your bill has increased since you started making payments. This could mean that you’re paying more than you should be. It’s essential to shop around for the lowest rate available. When looking at your options, don’t forget about the benefits of using a debt management service. These companies typically charge lower fees and provide additional services such as budgeting tools and automated alerts when payments fall behind.

While these services may seem like an added expense, they will help you save money in the long run.

Are Payday Loans A Good Option For Those With Bad Credit?

Payday loans may be a good option when you have a problem that requires cash quickly. They are explicitly designed to allow people with bad credit to borrow small amounts of money. While many people think they only serve those who have failed to pay their bills, this isn’t true. Anyone with a valid checking account and proof of income can qualify for a payday loan.

The process is pretty straightforward. After filling out some paperwork, you’ll receive an approval within minutes. Once approved, you’ll receive the money directly deposited into your bank account.

However, as with any form of borrowing, these loans come with risks. Typically, borrowers use them to cover emergencies such as car repairs or medical bills. But if you use them to make purchases that you cannot afford, you could face severe problems.

A recent study found that half of all payday loan customers defaulted on their debts. Of course, it’s possible that some were unable to repay their loans because they never had enough money to begin with. Still, others simply couldn’t keep up with the interest rates charged by lenders.

If you choose to apply for a payday loan, make sure you understand precisely how it works. Before you sign anything, read through the terms and conditions to ensure that you fully comprehend what you agree to. Also, remember that you can request free copies of all documents related to your application from the lender.

It may be challenging to secure a traditional loan if you have poor credit.

While these loans do come with higher interest rates, they still offer a solution to those who are struggling. If you qualify, you may be able to borrow up to $1,500 per month. Depending on your circumstances, you may be required to pay back the entire amount within two weeks.

However, before you sign up for a payday loan, you’ll want to research the lender you choose thoroughly. Make sure that you understand how the loan works, the terms, and whether or not you qualify. Payday lenders often require borrowers to have excellent credit scores, so it’s essential to check their reputation first.

Finding a reputable lender is just part of the equation. Once you’ve found a good match, you’ll need to ensure that you repay the loan on time every single month. Otherwise, you risk losing access to your funds.

Fortunately, there are alternatives available. One of the best ways to obtain financing is to turn to peer-to-peer lending sites. These platforms connect individuals who need money with other investors willing to lend funds. The process is simple and fast. You need to fill out a short online questionnaire and wait for the results.

Peer-to-peer lending is still relatively new. However, it has shown great promise among consumers who have struggled with traditional lenders.

In addition to providing access to capital, peer-to-peer lenders offer another benefit: transparency. Unlike traditional lenders, which often hide information about applicants’ financial status, peer-to-peer lenders share detailed records about each borrower. This makes it easy for potential investors to assess a person’s risk level and determine whether they are likely to repay the loan.

Several peer-to-peer websites specialize in funding personal loans.

Another alternative is to look into pawn shops. Most major retailers now accept payment by check. If you have a valuable item that you want to sell quickly, you should consider contacting your local store manager. They might be able to provide you with an appraisal and arrange for a quick sale.

Of course, no matter where you go to get a loan, you will need to provide documentation to prove that you meet the minimum requirements. Ensure that you include everything from your last two pay stubs to your most recent tax return when applying for a loan.

How Can You Utilise Personal Loans From The Companies Above?

Once the money gets credited into your bank account, it is entirely up to you how you use the money. This is the main difference between borrowing money from an online lender and a financial institution like a bank or credit union.

Even if you have a poor history, you will be able to avoid loans from traditional sources and have to answer how you will be using the money. All you have to worry about is repaying the money on time, and it is up to you how you use it.

Below are some suggestions on using the money you have borrowed despite having a credit score that is not in your favor.

Debt Consolidation Loans

People who do not have an excellent credit score are generally prone to requiring debt consolidation loans. When you obtain a debt consolidation loan, you can use the loan amount you have borrowed to cover existing depth and clear it off. Compared to the other loans, the debt consolidation option of a personal loan that you borrow from these platforms will have lower interest rates.

It’s excellent to note that you can get some of the best personal loans for your debt consolidation needs from the platforms that we have listed in the loan amount of your choice.

Car Title Loans

Buying a vehicle is a big deal, and you might require pretty high loan amounts. We have made sure that we have listed payday loan options without you going to a bank or credit union to get your money to buy the car you have wanted for so long.

Obtaining a vehicle is a significant undertaking, but a low credit score may prevent you from getting cash advances. You should hunt for the best-unsecured lending services and the lowest interest rate possible if you already have debt.

Even if you have existing debt and a credit score that is not very satisfactory, you can get a decent loan amount and maximum unsecured loan services at great interest rates through the platforms that we have listed.

Home Equity Loan

The loan amounts for home equity loans are determined after examining the current market worth of your home and how much of your mortgage you have to pay off. It is difficult to obtain a reasonable loan amount for home equity loans. Home equity loans typically have high-interest rates, and payday loans are difficult to obtain for those with existing debt.

You could also take out a personal loan. Check out the platforms we recommended for some of the best personal loans to care for your various needs, including home equity. Whether you wish to take a second mortgage on your home or not is entirely up to you.

Holiday Costs

Going on a holiday is not easy, especially when you have to borrow money to cover the vacation costs. You can use the loan amounts at low-interest rates to plan your vacation. The entire process of getting a loan amount does not have to be stressful, even if you have existing debt.

It might be a great idea to get a personal loan through the platforms offering bad credit loans for those with poor credit history. You can use the bad credit loan to plan your dream vacation and take a much-deserved break, irrespective of your credit score.

Moving Costs

Moving to a new place is highly stressful. There are so many things you need to consider, and sometimes you will have to borrow money to cover the moving costs, and the loan amounts you get from these platforms offering bad credit loans can help you with that.

Your poor credit history does not matter when looking for a bad credit loan. You can get joined and secured loans or personal loans through the platforms that we have listed. You can use the personal loan amount to cover your moving costs.

Emergency Cost

You never know when an emergency can arise, and it is a test to be prepared for the same. But if you are not prepared and do not have an excellent credit score to back you up, these loans can be used for emergencies.

Some situations can arise when you need to consolidate debt immediately, and these loan amounts can be used for such emergencies. You can get the personal loan amount you obtain to take care of any emergency because the personal loans for bad credit that you receive through these platforms are instantly credited to your account.

Bad credit loans that you get immediately can significantly help people with poor credit history. You can use the bad credit loan irrespective of your credit score to take care of any emergency needs, including accidents, helping family or friends out, or whatever else requires your immediate attention.

Wedding Expenses

Weddings can be a real headache when you have other worries in mind, such as consolidating debt on an emergency basis. Getting hold of reasonable personal loan amounts is essential when taking care of wedding expenses. When planning a wedding, you have no idea the exact loan amount you need.

You can get some of the best personal and bad credit loans at excellent interest rate options from the listed platforms, even if you have a poor credit history. Even if your credit score is average, you can avoid going through a bank that takes time and opt for a bad credit loan instead of from one of these platforms.

Anything Else

As we stated earlier, bad credit loans are not exactly given to you by a payday lender who has too many questions about how you will be using the loan amounts. Irrespective of your credit score, you can get a bad credit loan and use it the way you like. Your need can be attended to having fair credit or poor credit history.

Debt to income ratio does not matter when you consider taking a personal loan from one of our listed platforms. You do not have to worry about your credit score either, and can attend to any of your needs.

Secured Personal Loans Vs. Unsecured Personal Loans

Most financial institutions will only give you a secured loan. Getting personal loans for bad credit from banks can be almost impossible if your credit score is not up to the mark.

When you are looking for a personal loan but do not have a great credit score, it makes sense to get hold of unsecured personal loans in the payday loan amount you can afford. This way, you do not have to worry about having collateral.

You do not have to pay much of an origination fee either when you stick to the options that we have listed to get a bad credit loan instantly. You can repay your bad credit loan without worrying about a high origination fee and flexible monthly payment options.

What is a Secured Loan?

A secured loan amount is one that you can obtain from a payday lender or more traditional sources without the worry of any origination fee. Getting a secured loan amount requires you to have collateral to receive the personal loan.

And so, to get a secured loan amount, you will have to present the payday lender with collateral of some form, and if it is a bank, your debt to income ratio might be taken into consideration.

If you want to get your loans from traditional sources, then going for a secure one might be good if you can afford collateral to back you up.

What is an Unsecured Loan?

An unsecured personal loan is one that you can obtain even if you do not have collateral to back you up. Getting hold of an unsecured personal loan is not easy because most traditional institutions require you to have substantial collateral.

However, the lenders on the listed platforms offer unsecured personal loans to everyone. You can get an outstanding unsecured personal loan of a high unsecured loan amount from some of the lenders on our platform with much ease. Unsecured personal loans are preferred by most people who want personal loans without worrying much about arranging collaterals.

What Should Be The Minimum Credit Score To Get A Loan?

Maintaining a minimum credit score to get hold of personal loans can be quite troublesome if you do not have the minimum credit score needed to obtain these personal loans from banks. Ideally, the minimum credit score or your credit report should not matter when you want to secure a loan amount.

A bank or credit union can be very particular about minimum credit score or minimum annual income and your credit report when providing you with personal loans. Using our listed platforms, you can get money credited into your checking account without maintaining a minimum credit score.

How Can You Improve Your Credit Score?

There are several things you can do to raise your score over time. Below, we have described in detail what you can do to improve your credit score:

Pay Bills On Time

One of the biggest reasons your credit score could be below is that you’ve missed payments on bills. If this happens often, it will hurt your score. So make sure you pay all your bills on time every month. You should also avoid paying late fees as they will negatively affect your score.

Don’t Apply For New Credit Cards

Applying for multiple credit cards at once can cause your credit score to drop because it looks like you’re trying to take out too many loans at once. Instead, wait until you have more than $1000 in savings to apply for another card. This way, you won’t appear desperate, and you’ll give yourself plenty of time to pay off the existing credit card before applying for another one.

Use Only One Bank Account

Having more than one bank account can negatively impact your credit score. Banks report balances differently depending on which account you use most often. So, you might want to consider using just one checking account.

Get Out Of Debt

It may seem impossible to get out of debt, especially if you have high-interest rates on some of your credit cards. However, getting rid of debt can help your credit score dramatically. When you start repaying your debts, your payment history improves. And when creditors see that you are managing your finances well, they might let you reduce your interest rate or extend your repayment period.

Sign Up For Online Bill Paying

This is an easy way to manage your monthly expenses without writing checks. Plus, online bill paying allows you to avoid late fees. You can sign up for free online services such as Mint or H&R Block TaxCut.

Check Your Reports Regularly

Make sure you check your reports regularly to know exactly where you stand. In addition to looking at your credit score, you should also review your credit report to make sure everything is correct.

Fix Errors

If something isn’t listed correctly on your credit report, contact the creditor immediately to fix the error. Also, if you find errors with your credit score, contact the three major credit reporting agencies – Experian, TransUnion, and Equifax – to have them removed.

Have A Good Reputation

You can build a good reputation by paying your bills on time and keeping your other financial obligations under control. If you keep these things in mind, you can make a positive reputation that will positively influence your credit score.

Increase Your Limit

If you currently only have $1,000 available to borrow, it may not be enough to purchase a home. However, increasing your limit to $5,000 might help you get approved for more expensive loans.

Don’t Use Cash Advances For Expensive Items

Many people think that using cash advances to pay for items like vacations and cars will boost their scores. This isn’t true. Using these types of loans hurts your score.

Start Building Positive History

There are two ways to build positive history on your report card: Paying down your balances and making timely payments. While it’s important to pay down your balances, don’t stop at just paying them off altogether. Make sure you keep up with payments to build a good history.

Use Only One Card

Using multiple credit cards can cause problems for your credit score. They can appear as different names on your statement and increase the amount of interest you accrue. Plus, many stores offer discounts if you spend money through their rewards program.

Get Preapproved For A New Car

Getting pre-approved before buying a new vehicle is another way to build positive history on a credit report. Many car dealerships will allow customers to apply online for financing, so you won’t have to wait weeks for an approval letter after applying.

Keep Up With Applying For Cards And Monitoring Accounts

Applying for new accounts and monitoring old ones can help you build a credit history. Lenders want to see that you’re responsible for your finances. Therefore, you shouldn’t close accounts or apply for too many new cards without first checking your existing balance. Also, monitor your credit reports regularly to ensure no errors pop up.

Improving your credit score doesn’t happen overnight. However, with some effort, you can start building a better record. Remember that the best way to improve your credit score is to follow the tips above.

The Best Bad Credit Lenders in 2022 Final Verdict

Using these top bad credit lenders, you can avoid bank payday loans and connect with lenders without charging hefty origination fees. The origination fee is low, but the loan amount you get is flexible. You don’t have to maintain a minimum credit score to get loans for bad credit. Bad credit borrowers can use these top bad credit lenders to take care of debt consolidation irrespective of their debt to income ratio.