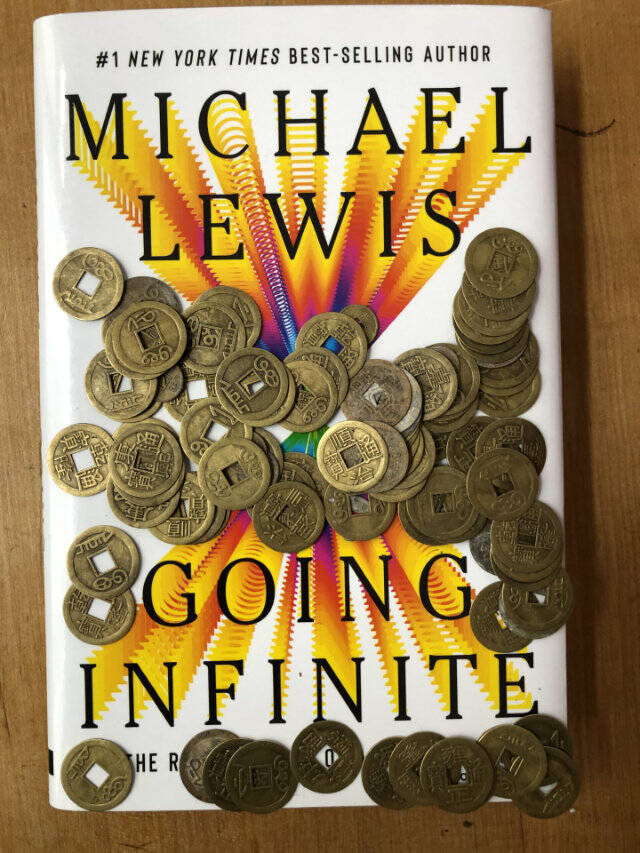

If there were ever a cautionary tale for our time, it would be “Going Infinite.”

We in the American-infused modern world love our superheroes (and villains), our renegades, wunderkinds and entrepreneurs and those who succeed beyond all odds — and, as a bonus, those who bend the world to their own will and live by their own rules.

From politicians to criminals to CEOs and founders of start-ups, we love, and can’t help our intoxicating obsession with those who inhabit a world few of us could begin to imagine.

Money and power are, and perhaps always have been, the ultimate intoxicant and illusion.

Greed, for better or worse, is energizing and inspiring.

But what could be even more energizing and inspiring than greed “baptized” in the name of worthy causes?

Conquest in the name of God, or even empire, is passe, but wealth in the pursuit of “good” is, or at least a year or so ago, was, commendable.

A story like SBF had to happen — individuals not terribly interested in the accouterments and distractions of wealth — had, either accidentally or serendipitously, discovered some underlying principles or probabilities that governed, often without visible (to most of us) impacts or under-currents that control, far more than standard rules of the market — like supply and demand.

Enter cyber-currencies

When the author of this book, which is more of a chronicle than a normal book, Michael Lewis, described crypto-currencies as a financial instrument that, even when explained, “doesn’t stay explained”.

State authorized monetary systems, from the US dollar to the British pound are fickle and abstract enough. Currencies “float” (in value in relation to other currencies) and are or course impacted by global trade, interest rates, resource challenges, and of course wars and national debt.

Multiply these variables by a hundred or so and you have a sense of the variables of promise and catastrophe of crypto-currencies.

When the author first met him, Sam Bankman-Fried (aka SBF) was the world’s youngest billionaire, well on his trajectory to becoming the richest individual in the world, and crypto’s crumpled Gatsby figure– host and more than reluctant spokesman for the “next big thing”.

And “big” it was. Millions became billions and billions were on the verge of becoming trillions.

It was just a matter of time, many believed (and were literally baking on) until SBF became the world’s first trillionaire.

CEOs, celebrities, and leaders of small countries, among many other idealists and opportunists, vied for his time and cash after he catapulted, seemingly overnight, onto the Forbes billionaire list.

Who was this rumpled guy in cargo shorts and limp white socks, who had little use for “adults” with their pesky laws, rules and guidelines about everything from dinner attire to monetary controls — even what money actually is, or should be?

He was annoyed by grown-ups, and for better or worse, was a pre-teen (if that) in a grown-up body. Even in multiple million dollar deals across Zoom meetings his eyes twitched as he played video games on the side. In Going Infinite Lewis sets out to answer this question, taking readers into the mind of Bankman-Fried, whose rise and fall offers an education in high-frequency trading, cryptocurrencies, philanthropy, bankruptcy, and the justice system.

Both psychological portrait and financial roller-coaster ride, Going Infinite is Michael Lewis at the top of his game, tracing the mind-bending trajectory of a character who never liked the rules and was allowed/enabled to live by his own―until the obvious happened.

Empires, political or financial, do not build themselves, and one person, no matter how charismatic or convincing, could do it by themselves.

But this is no traditional Ponzi scheme or con game; it about “infinite dollars”.

It’s not about the money

It has become a truism that when someone says “It’s not about the money”, it certainly is.

But for SBF and friends, it really was NOT about the money — at least in the usual sense.

SBF and his acolytes lived, a relatively spartan lifestyle, but money, in vast amount, flowed in unlikely ways to even more unlikely places.

What could go wrong with super-smart (or so they tell us) visionaries who want to do “good” for the greatest number of us?

There is nothing new about reputation laundering through philanthropy. Consider the “tycoons” of our age – Marc Andreessen, Mark Zuckerberg, Jeff Bezos and Elon Musk — among others.

Previous tycoons from Carnegie to the Vanderbilts left behind libraires and universities. What are the current generation leaving the rest of us?

“The whole operation was run by a gang of kids in the Bahamas”

— Anonymous observer

From the very beginning, the lack of “adults in the room” raised a huge number of questions if not red flags; the partisan political donations, the blatant failure of the most basic investor due diligence, and of course, the strategic if not idealistic philanthropic bias led investors and any authorities to, for whatever reason, overlook danger signs along the way.

Every fact of the FTX fiasco seems to highlight and reveal unavoidable, intractable 21st century social, technological or political dilemmas.

From gambling (at multi-million-dollar stakes) with other people’s money (OPM) with an ever-increasing “risk appetite” all in the name of good causes, to use phrase that just might define our age, what could go wrong?

With millions of dollars in “wallets” and “funds” with literal cash, feeling clunky and inflexible, money flows, grows and, as is often the case, implodes with little, if any, intersection with actual values or even meaning.

What could be a better base for economic gain than the belief that by doing well, we might also be doing good?

The premise of cyber-currencies (if not all currency) is trust. And, to add irony on irony, (or perhaps to explain it all) SBF’s parents were respected scholars of corporate tax law and ethics at Stanford University.

SBF’s mother Barbara Fried, wrote a paper in 2013 titled “Beyond blame” which could be summarized as arguing that “the philosophy of personal responsibility has ruined criminal justice and economic policy. It’s time to move past blame.”

Whether we agree, like or are horrified by such a morally ambiguous landscape, it is, without a doubt, the world we live in. From Jeffery Epstein to the financial manipulations that led to the Great Recession to crimes, riots and the events of January 6th, personal responsibility/accountability has become as rare as migrating chickens.

This was the reigning philosophy that gave us the economic collapse and general disgrace behind the evaporation of literally billions of dollars.

The operating principle of SBF was/is that every society is a mass of largely interchangeable individuals engaged in purely rational decision-making in a marketplace, and most of us, if we were “logical” would prefer to dispense with inconveniences like religion, community and, yes, ethics, as impediments to the smooth global flow of data and economic units.

In other words, dollars, empires and political platforms rise and fall, like seasons or tides, being pulled by unseen forces, and we as individuals have little, if any agency, but some, apparently, can indeed “rig” the system.

This book has received mixed reviews, but for better or worse, it is a snapshot of where (and maybe who) we are.