By Morf Morford

Tacoma Daily Index

When Warren Buffett (third-richest man in the world, and CEO of Berkshire Hathaway) speaks, any of us would be wise to listen.

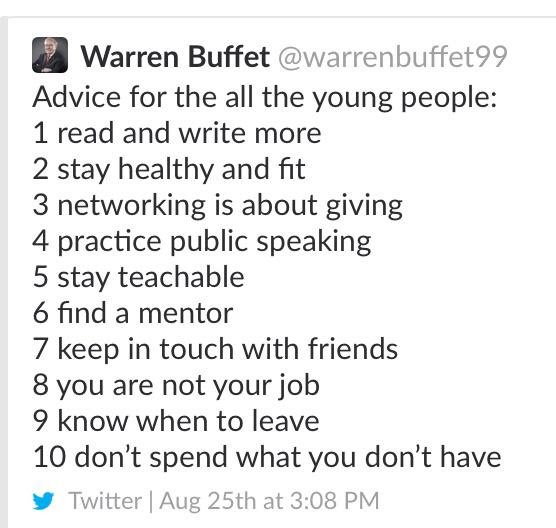

And if someone speaks under his name, it is actually still a good idea to listen.

Good advice is good advice, no matter who says it. Or at least that seems to be the guiding principle of a fake Twitter account that operated under Buffett’s name (@warrenbuffet99).

The advice is not profound – it is in fact blindingly obvious – but that doesn’t make it any less necessary – if not urgent – for an era which could be defined by its disorientation and neglect of standard – and obvious – rules and guidelines of public discourse and behavior.

Fake accounts, on any social media platform are usually fairly easy to recognize – misspelling of a name, lack of proper capitalization and neglect of some of the nuances of proper grammar are some of the usual markers of a fake account.

That account has been suspended, but not before nearly 300,000 other Twitter users have liked the life-advice for young people tweet, and over 127,000 have retweeted it.

How about this “fake” advice to the “smartest people I know”?

Could any of us imagine a conversation about almost anything – music, food, politics, money, literally any topic, where the conversation was encouraging and invigorating – and more importantly – the next conversation is something to look forward to – not dreaded?

Our personal holidays and conversations have become mine-fields of hot topics, buzzwords and political slogans.

Wouldn’t most of us welcome some civil discussions and mutual respect as we address difficult – but essential issues.

Is this advice really that difficult to follow?

The real Warren Buffett is certainly worth paying attention to as well. His official account is @WarrenBuffett, which has about 1.5 million followers, is verified by Twitter, and has not yet issued a comment on the fake account.

If you prefer to take your advice more Warren Buffett style, you could pick up any of his books.

Buffett’s actual advice is almost always equally commonsense, and straight-forward talk; “Be fearful when others are greedy. Be greedy when others are fearful.” for example.

Here are some of his thoughts on some key categories of life, work and, of course, investing.

On life:

1. “You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

2. “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be a more productive than energy devoted to patching leaks.”

3. “It is not necessary to do extraordinary things to get extraordinary results.”

4. “What we learn from history is that people don’t learn from history.”

5. “Chains of habit are too light to be felt until they are too heavy to be broken.”

6. “There seems to be some perverse human characteristic that likes to make easy things difficult.”

7. “Nothing sedates rationality like large doses of effortless money.”

8. “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

9. “It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.”

10. “Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

On investing:

1. “The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

2. “Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.”

3. “I don’t look to jump over seven-foot bars; I look around for one-foot bars that I can step over.”

4. “In the short term, the market is a popularity contest. In the long term, the market is a weighing machine.”

5. “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

6. “Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.”

7. “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

8. “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

9. “I am a better investor because I am a businessman, and a better businessman because I am an investor.”

10. “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

I don’t know about you, but Warren Buffett’s advice strikes me like a breath of fresh air – a presumption of decency, not suspicion, trust in place of betrayal and encouragement instead of pessimism.

As Warren Buffett might put it, success in business is not ultimately about the money – it is about the reputation and legacy we leave behind. That’s the ultimate investment.