By Morf Morford

Tacoma Daily Index

“Left Behind” was a popular book series in some circles twenty or so years ago.

Unfortunately, “Left Behind” has become an economic threat, even a definite possibility, for too many of us in the early 2020s.

The “K” shaped economy is hitting us, and the entire world, right now with a vengeance.

With one “arm” pointed up, and the other pointed down, the relentless economic “conveyer belt” pulls us, almost without our contribution, like a strange gravitational pull.

Illness, job loss, medical costs, eviction, ruined credit and family disintegration are only a few of the life and economic impacts hitting far too many of our friends and neighbors.

That’s the way down.

The way up is just as dramatic.

As real estate values rise, those who have real estate profit at unimaginable levels, those who don’t, slide even further behind.

The old saying that a rising tide lifts all boats presumes that everyone has a boat – and that every boat is seaworthy. 2020 has taught us how unforgiving a “rising tide” can be.

Some of us are working more, some of us are earning more, even much more, than ever before.

In contrast to other eras however, working more does not necessarily correlate to earning more.

Some, like delivery people, are working far more and barely eking by. Others are working far less and earning far more.

Side-hustles, from being an Uber, Instacart or Lyft driver, to playing the stock market or eBay are exploding and metastasizing in shapes and forms like never before. Some are profitable – even wildly beyond imagination, some are reasonable and some are disasters.

The trick to investing (and maybe everything) is very simple; stick to what you know.

If you don’t understand the principle of “shorting” a stock, for example, don’t even try it.

It might work well for others, but not for you.

Fortunes have been made based firmly on the “greater fool” philosophy; the assumption that, no matter how “foolish” our investment might be, if we can find someone who is an even greater fool, our investment just might pay off.

For better or worse, we seem to have a near-endless supply of “greater fools”.

And an equally near-endless supply of those willing to take advantage of them.

So the economic tables tilt even further. And the economic gravitational pull becomes even harder to resist.

As the jazz great Miles Davis put it – “It’s not the note you play that’s the wrong note – it’s the note you play afterwards that makes it right or wrong.”

No matter what you invest in, from hand sanitizer to GameStop stock to real estate, it’s not your move that makes the difference, it’s the move someone else makes after you make yours.

Your investment might be the best, or absolute worst decision ever, but it all depends on what follows.

If you read the news, or drive around town or even just talk to people you know, you see both extremes gathering ever more momentum; investments pay off dramatically or implode on contact with the harsh realities of the market place.

Some swings in valuation might be to your advantage – for now or for a while. But the pace (and direction) of change is difficult to channel, and thanks primarily to technology, the frenzy only seems to continue and the challenges, complications and repercussions only seem to multiply.

The stakes – and opportunities – only seem to become greater.

The biggest challenge though, just might be to avoid being the ultimate “greater fool”.

***

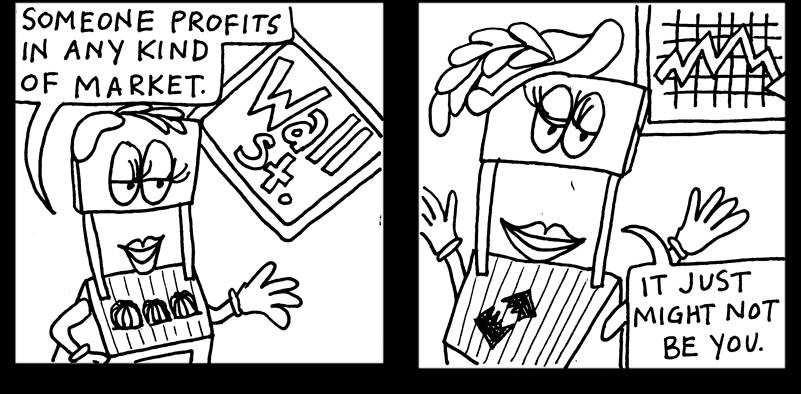

Image courtesy Megan Sukys; See the full color panel at her website, http://www.megansukys.com/2021/01/29/the-market-speaks-for-itself/