By Morf Morford

Tacoma Daily Index

Nothing defines “The American Dream” more than the possibility or even presumption of individual home ownership.

Renting, for most of us, is seen transitional.

Young people, especially those going to college, almost universally rent. Adults, particularly those with stable incomes, if not professions, buy their homes.

At least that’s how it used to be.

The benchmark used to be, if you expected to stay less than five years, you should rent. Anything more than that would justify purchasing a home.

Again, that’s how it used to be.

Five years in today’s real estate market – especially in the greater Puget Sound region – is an eternity. Housing prices could easily double – or drop precipitously – or in some segmented markets – flip either way over an intense weekend, or because of fluctuating foreign markets, or wildly swinging exchange rates or as a result of catastrophic natural events like flooding or earthquakes.

If you consider the housing market for, let’s say the past ten or twelve years, we’ve seen waves of foreclosures, cable news shows with a focus on house “flipping”and a near-gold rush mentality when it comes to real estate investing.

And on the margins of this feverish real estate market we’ve seen the rise of something most of us never expected to see in America – or even any modern nation; widespread, semi-permanent homelessness.

We have always had homeless transients, and we have probably always had a few locked out of home ownership, but housing, being a basic necessity, has always been “affordable”. (1*)

Cheap rentals, for millennia, have always been available for those in transit or upheaval.

Homeless families have consistently been a barometer of an economy, or even society in a state of free-fall.

To put it mildly, homeless families are never an indicator of a healthy economy – or society.

The term “cheap rental” belongs in a glass case in some kind of real estate museum alongside other artifacts of a distant era of fax machines and audio cassettes.

Anyone who is renting knows all too well what an archaic concept that term implies.

And five years in our housing market? How about one year? Six months?

I randomly typed in an address in Tacoma’s Proctor District. According to Zillow, this particular property had appreciated over $9,000 in the previous thirty days (that’s a bit over three hundred dollars a day).

In this market, fortunes can be made (or lost) in six months.

Buying a home for the long term could easily be the best – or worst – investment any of us could make in our lifetime.

The irony in all this is that, in most cases we are not talking about investments, we are talking about the most basic human need of all – the shelter and safety of a stable home.

It would be as if people in business suits and plush office suites made fortunes speculating on drugs that kept people they would never meet alive a thousand miles away. The slightest flick of a pen could send a stranger (and their family) into chaos, if not death.

Like essential drug prices, ever increasing real estate prices are no abstraction. Families are literally locked out of the housing market.

The term “affordable” only exists because it has to – it is like the term “honest” on the name of a used car dealership; if you see it, you know it isn’t true.

But like everything else that used to be reliably true in a simpler age, say two or three years ago, few “truisms” regarding real estate are still true.

It used to be said that “real estate is your best investment”.

And it used to be true. But I know too many people who were driven into near bankruptcy because of their real estate investments.

The Great Recession gave us real estate terms like “underwater” or “upside down” to designate the abrupt – and usually long term – loss in real estate value.

Even a basic economic principle like supply and demand in today’s real estate market is irrelevant if not preposterous.

Across the country there are about the same number of abandoned and neglected homes as there are homeless individuals.

In our urban areas construction of housing in the past five years or so has grown at an explosive pace – but so has the rate of homelessness.

Housing is not being built to be used as housing but, ever more, as an investment vehicle.

I see expensive units being built and they sit empty. They are beautiful and few can afford to live there.

The disparity between renters and homeowners seems to grow every day. Over a lifetime, the equity gained is massive.

For too many builders, whether it is occupied or stands empty, for the investors at least, doesn’t really matter.

It’s an investment or a tax write-off.

It’s not a home. But it could be, and in a sane age, it would be.

There are about 80,000 households in Tacoma. About half of them are owner-occupied. This means that about 40,000 households are renting.

The fluctuations in monthly rents hit them hard – and push too many of them literally out the door. (2*)

Maybe we need more housing, but I am convinced that what we really need is more appropriate housing – mid-range in price and mid-range in scale.

I see massive apartment complexes that dominate the landscape and make it monotonal and sterile.

Besides housing, people need a community. Smaller buildings – maybe 6-8 units – create neighborhoods – they don’t overwhelm and stifle them.

(1*) Both words “homeless” and “affordable” (as it relates to housing) are relatively recent words, coined in the 1980s.

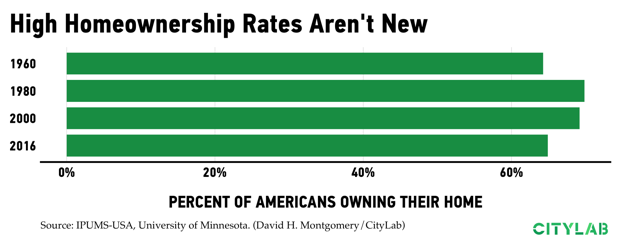

(2*) Another benchmark that has been lost is that we should spend no more than a third of our income on housing. More and more renters spend about 10-20 percent more than they should. And have little choice in the matter. To see more on the dynamics of owning versus renting, take a look here – https://www.citylab.com/life/2018/08/who-rents-their-home-heres-what-the-data-says/566933/?