The U.S. economy expanded at a 2.1% annualized rate during the second quarter of 2019 with consumer spending leading the way, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. This rate of growth exceeded the consensus expectation that second quarter growth would be closer to 1.8%.

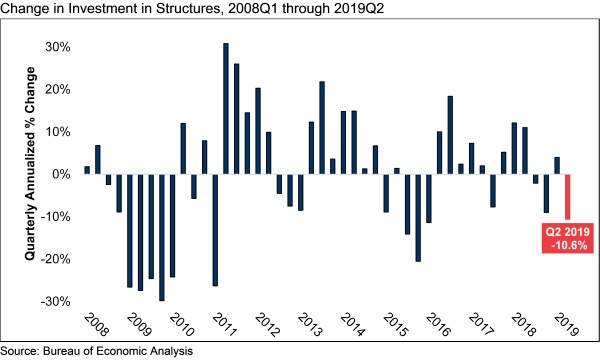

However, nonresidential fixed investment, a key component of business investment, declined at a 0.8% annual rate in the second quarter. Investment in structures plummeted at a 10.6% annual rate, the fastest decline since the first quarter of 2016.

“Today’s GDP data fit neatly with construction spending data, which have been indicating a slowdown in private construction outlays,” said ABC Chief Economist Anirban Basu. “Earlier in the cycle, nonresidential construction spending growth had been driven by rapidly expanding investment in segments such as office/data centers, lodging and commercial. During the past year, however, spending growth has been motivated largely by public infrastructure outlays, which helps explain the positive contributions made to second quarter GDP by state and local governments.

“Overall economic growth is not slowing as rapidly as feared when the May employment report emerged,” said Basu. “The June employment report was considerably better, and the initial second quarter GDP estimate is more positive than anticipated. Still, nonresidential contractors have reason for concern. Business investment is meaningfully lower than it was in 2018, evidence that the impacts of tax cuts have begun to wane. While consumer spending growth is consistent with ongoing investment in retail, warehousing and fulfillment centers, softening business investment hints at slower job growth going forward, which would impact demand for office space and other forms of employment-supporting space.

“On top of that, next year’s presidential election could have a chilling effect on economic activity as a variety of economic actors adopt a wait-and-see attitude,” said Basu. “The uncertainty of the election, combined with elevated levels of household and corporate debt, creates a vulnerability that hasn’t been apparent for quite some time. If today’s very elevated asset prices begin to wobble, 2020 could end up being much worse for the broader economy than the 2017-2019 period. Ultimately, next year could be the beginning of the end for the current nonresidential construction spending cycle.”