China, India and Indonesia as the world’s fastest growing economies?

By Morf Morford

Tacoma Daily Index

If you think observing, analyzing and making sense of our national economy is a challenge, try making sense of the twists and turns of a global economy at the whim of trade wars, climate upheavals, natural catastrophes, demographic changes, civil wars and break-neck technological and consumer shifts, to name a few.

Some national economies, like China grow at a blistering speed (sometimes more than 20% annually) and then turn (relatively) sluggish, to a rate, like about 7%, when most us would be thrilled to maintain even half of that rate.

Factor in population growth (and projected dramatic decline), and the next few years are anybody’s guess.

But it could also be said that the seeds of the next few decades have already been planted.

The balance of economic power has always been in flux. Empires and industries rise and fall at a rate few of us could even follow, let alone anticipate.

For most of us, a core assumption has been that the US is, and should remain, the world’s economic powerhouse. Our faith is almost Biblical – the USA is destined for prominence – if not control – of the world economy.

You don’t have be a research analyst to realize that an economy like ours, that grows at about 3% per year, will, after only a few years, be left in the dust by any economy that grows at 10% or more.

We in the United States were on the positive side of multiple economic and demographic trend lines for decades.

After World War II, as pretty much the only industrial nation with its infrastructure intact, manufacturing and the rebuilding of Europe and much of Asia (South Korea and Japan) stirred our economy into post-war hyperdrive.

Add in a baby boom generation and the housing, education and entertainment industry catering to them and you have everything from housing developments to pubic schools and Hollywood films generating jobs – and profits – like no other economy in human history.

You also don’t need to be a genius to know that such a system cannot last forever.

I know that sounds like heresy, but if you travel the world – or pay attention to world events beyond the American news-cycle bubble – where economic policy and power shifts are covered instead of celebrity antics, it could not be more obvious.

If you went back in time to perhaps 1940, the United States economy was secondary (if that) to almost every country in Europe. Europe dominated the economy and culture in just about every realm from music, art and literature to military and finance from about the 1850s to the mid-1940s. They too, thought their hold on the levers of power were destined – and permanent.

North America (and to a large degree Central and South America) were primarily suppliers of raw materials to the more industrial economies of Europe.

The USA was primarily agricultural with a vast population of small, independent farmers and craftsmen. (1*) It took a world war (or two) to transform the USA to the manufacturing behemoth that it became in the 1950s and beyond.

By the 1970s the obvious happened – those factories and industries rebuilt in Europe and Asia were producing quality products cheaper and more efficiently than the older (pre-war) manufacturing facilities of the US.

US factories by the thousands shut down, terms like “the Rust Belt” came to define our rapidly declining industrial landscape.

Industries – especially the financial sector – consolidated. Instead of thousands of independent financial institutions – and a clear line between banking and investing (2*) we have a few (about ten) massive banks with assets in the trillions (which define themselves as “too big to fail”).

No economy or industry is really “too big to fail” – it is the favorite fantasy of every empire, but it has never held true – “failure too big to recover from” might be a more reliable economic benchmark.

You could make the argument that much of Europe – and even Japan – are still recovering from a war that ended 75 years ago.

But look at the economies of the future.

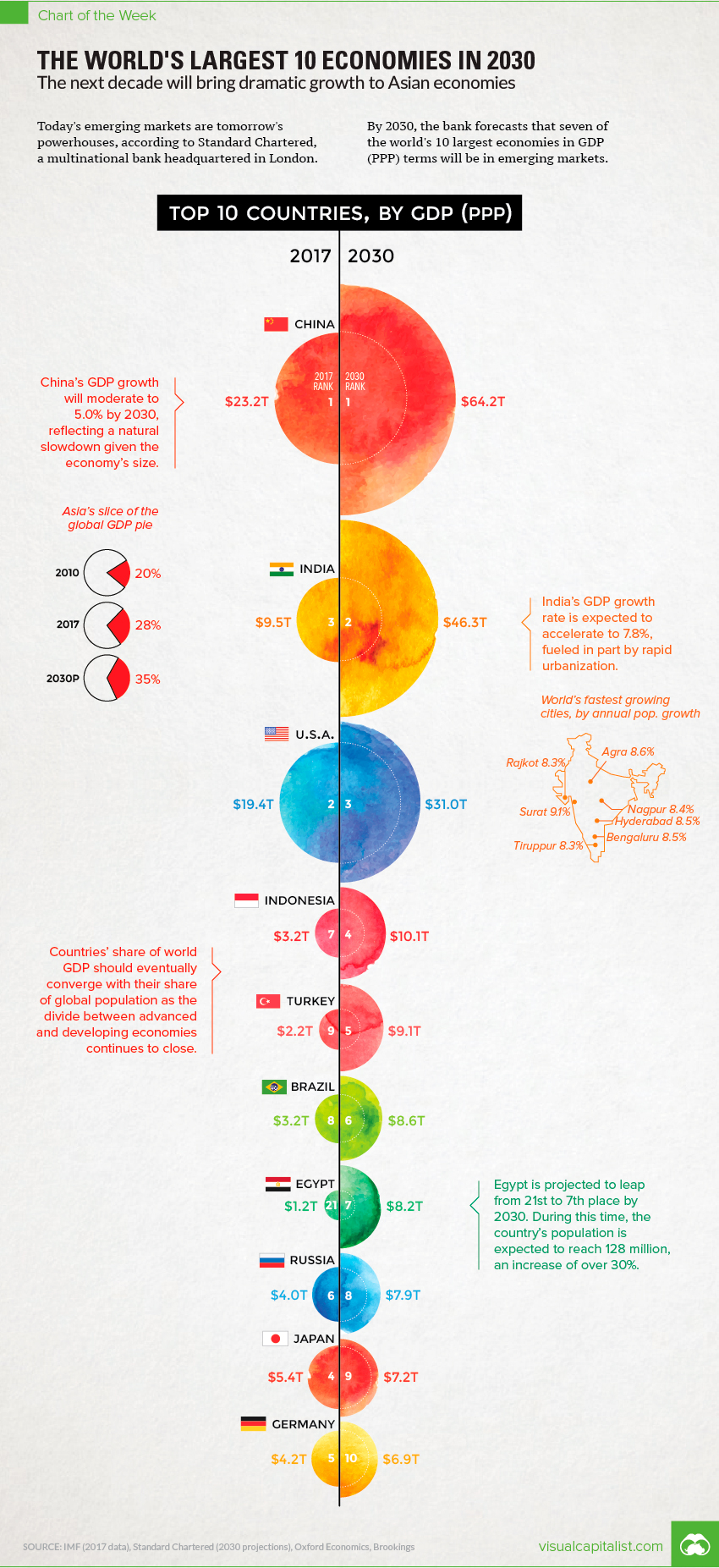

Any observer of the global economy would have noticed the emergence of China – but who expected to see India – or Indonesia in the top five economies of the world?

We currently have the G7 – the Group of Seven (G7) is an international intergovernmental economic organization consisting of the seven largest IMF-advanced economies in the world: Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

As of the end of 2018, the seven countries involved represent 58% of the global net wealth ($317 trillion) and more than 46% of the global gross domestic product (GDP). In the year 2030, how many of those countries will be in the top seven – or even ten?

That’s only ten years from now, but the trends are already clear.

Asia – and not just China – is expanding rapidly.

Far from the Eurocentric G7, we will have a mix – from Turkey(!) to Brazil with Germany barely hanging on at the number ten spot. (3*)

Some who have done the math expect the USA to be in the middle of the pack in ten years.

The first lesson one learns from history is that nothing is certain – and nothing is permanent.

(1*) In 1947 there were about 8 million farmers employed, declining to 3.4 million farmers working in 1998. Most of them, at least in 1947, owned their own farmland

(2*) The Glass-Steagall Act, part of the Banking Act of 1933, was landmark banking legislation that separated Wall Street from Main Street by offering protection to people who entrust their savings to commercial banks.

(3*) https://www.visualcapitalist.com/worlds-largest-10-economies-2030/